Our papers are the official record of our discoveries. They allow others to build on and apply our work. Each one is the result of many months of research, so we make a special effort to make our papers clear, inspiring and beautiful, and publish them in leading journals.

- Date

- Subject

- Theme

- Journal

- Citations

- Altmetric

- SNIP

- Author

J. Wang

J. Wang T. Fink

T. Fink A. Stepanenko

A. Stepanenko M. Burtsev

M. Burtsev A. V. Kosyak

A. V. Kosyak Y. He

Y. He O. Gamayun

O. Gamayun E. Sobko

E. Sobko F. Sheldon

F. Sheldon F. Caravelli

F. Caravelli I. Shkredov

I. Shkredov A. Sarikyan

A. Sarikyan A. Esterov

A. Esterov A. Ochirov

A. Ochirov M. Reeves

M. Reeves G. Caldarelli

G. Caldarelli R. Hannam

R. Hannam A. Coolen

A. Coolen O. Dahlsten

O. Dahlsten A. Mozeika

A. Mozeika M. Bardoscia

M. Bardoscia P. Barucca

P. Barucca M. Rowley

M. Rowley I. Teimouri

I. Teimouri F. Antenucci

F. Antenucci A. Scala

A. Scala R. Farr

R. Farr A. Zegarac

A. Zegarac S. Sebastio

S. Sebastio B. Bollobás

B. Bollobás F. Lafond

F. Lafond D. Farmer

D. Farmer C. Pickard

C. Pickard T. Reeves

T. Reeves J. Blundell

J. Blundell A. Gallagher

A. Gallagher M. Przykucki

M. Przykucki P. Smith

P. Smith L. Pietronero

L. Pietronero

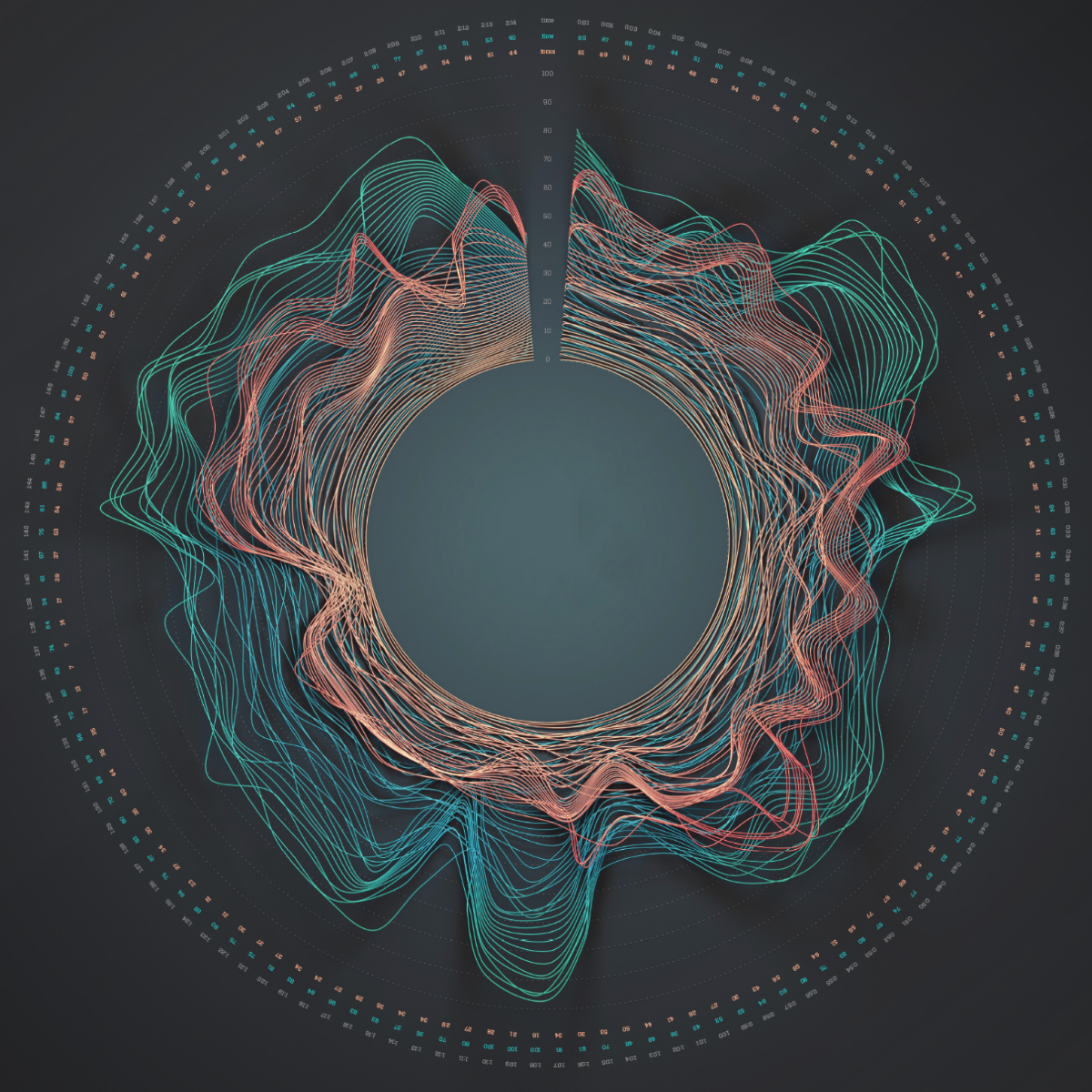

Network theory

Physics of financial networks

Statistical physics contributes to new models and metrics for the study of financial network structure, dynamics, stability and instability.

Financial markets

Network valuation in finance

Consistent valuation of interbank claims within an interconnected financial system can be found with a recursive update of banks' equities.

Financial risk

Pathways towards instability

Processes believed to stabilize financial markets can drive them towards instability by creating cyclical structures that amplify distress.

Complex networks, Financial risk

Non-linear distress propagation

Non-linear models of distress propagation in financial networks characterise key regimes where shocks are either amplified or suppressed.

Percolation theory

Clusters of neurons

Percolation theory shows that the formation of giant clusters of neurons relies on a few parameters that could be measured experimentally.

Financial risk

DebtRank and shock propagation

A dynamical microscopic theory of instability for financial networks reformulates the DebtRank algorithm in terms of basic accounting principles.